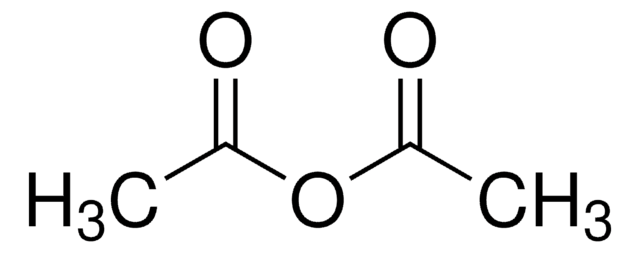

According to TechSci Research report, “India Acetic Anhydride Market- By Region, Competition, Forecast and Opportunities, 2019-2029”, the India Acetic Anhydride Market achieved a total market volume of 75.91 thousand Metric Tonnes in 2023 and is poised for strong growth in the forecast period, with a projected Compound Annual Growth Rate (CAGR) of 3.45% through 2029. The Indian acetic anhydride industry has seen significant technological advancements in recent years, which have contributed to its growth and competitiveness in the global chemical manufacturing landscape. Acetic anhydride, a vital chemical intermediate, is used in the production of various pharmaceuticals, dyes, and agrochemicals. These technological innovations have not only enhanced production efficiency but also improved environmental sustainability and safety standards. One of the most notable advancements in the Indian acetic anhydride industry is the adoption of modern and more efficient production methods. Traditional methods involved the carbonylation of methyl acetate or acetic acid, which was energy-intensive and generated significant waste byproducts. In contrast, the industry has shifted towards the use of advanced catalysts and proprietary reaction technologies, which not only reduce the energy consumption but also minimize waste. This transition has improved the overall process efficiency, leading to higher yields and cost-effectiveness.

Browse over XX market data Figures spread through XX Pages and an in-depth TOC on "India Acetic Anhydride Market” - https://www.techsciresearch.com/report/india-acetic-anhydride-market/20573.html

Furthermore, process automation and digitalization have played a pivotal role in streamlining operations and ensuring consistent product quality. Automation of various stages of acetic anhydride production, such as feedstock handling, reaction control, and product purification, has minimized human error and improved the precision of the manufacturing process. Additionally, the integration of real-time monitoring and data analytics has allowed for predictive maintenance, helping companies detect potential issues before they lead to costly downtime. Environmental concerns have led to innovations in waste management and sustainability within the acetic anhydride industry. Efforts to reduce environmental impact include the development of efficient waste treatment processes, which minimize the release of harmful byproducts. Moreover, the industry has invested in cleaner and greener energy sources, reducing its carbon footprint. This shift towards sustainability not only aligns with global environmental goals but also enhances the industry's reputation and marketability. Safety standards have been significantly improved with the introduction of cutting-edge technology. The handling of hazardous materials and the management of potential risks in acetic anhydride production have seen advancements in terms of both equipment and safety protocols. The use of sophisticated safety systems, such as emergency shut-off mechanisms and gas detection devices, has minimized the risk of accidents and exposure to toxic substances. Additionally, personal protective equipment has become more technologically advanced, ensuring the well-being of the workforce. Quality control and assurance in the acetic anhydride industry have also been enhanced through technological means. Sophisticated analytical instruments and testing methods have been introduced to monitor and certify product purity. This guarantees that the acetic anhydride produced meets the strict quality requirements of various downstream industries, particularly pharmaceuticals, where product purity is of paramount importance. The adoption of modern supply chain management software and logistics technology has enabled better inventory control and more efficient transportation of acetic anhydride products. This has led to shorter lead times and a reduction in storage costs, ultimately benefiting both manufacturers and consumers. The Indian government's focus on promoting research and development in the chemical industry has also spurred innovation within the acetic anhydride sector. Public-private partnerships and incentives for research have led to the development of new, advanced chemical processes and technologies, which not only enhance domestic production capabilities but also drive export potential. In conclusion, the Indian acetic anhydride industry has experienced a technological renaissance that has significantly improved production efficiency, environmental sustainability, safety, and product quality. These advancements have not only bolstered the industry's competitiveness but also aligned it with global standards for responsible and sustainable chemical manufacturing. As the demand for acetic anhydride continues to grow, India's commitment to technological innovation will likely keep the industry at the forefront of global chemical production.

The India Acetic Anhydride Market is segmented into application, end user, regional distribution, and company. Based on the application, the coating material segment emerged as the dominant player in the Indian market for Acetic Anhydride in 2023, driven by its pivotal role in various industrial and consumer applications. The dominance of the coating material segment can be attributed to the versatile and valuable properties of Acetic Anhydride in coatings. Acetic Anhydride is a key chemical used in the synthesis of cellulose acetate, a significant component in the production of high-quality coatings and lacquers. These coatings are widely utilized in the automotive, furniture, and construction industries, as well as for wood finishing and architectural applications.

Furthermore, India's growing construction and automotive sectors, coupled with increased consumer awareness of product quality, have fueled the demand for coatings that provide enhanced durability, gloss, and protection. Acetic Anhydride's role in the production of high-performance coatings has made it a preferred choice in the coating material segment. Moreover, the segment caters to the increasing emphasis on sustainable and eco-friendly coatings by supporting the development of water-based and low-VOC (volatile organic compounds) coatings. Acetic Anhydride contributes to the formulation of such environmentally responsible coatings. In conclusion, the coating material segment's dominance in the Indian Acetic Anhydride market is a result of its critical role in providing high-quality coatings for a range of applications, its alignment with the nation's growth in construction and automotive industries, and its contribution to sustainable and eco-friendly coating solutions. This dominance is expected to persist as India's demand for advanced coatings continues to expand.

Based on region, the Western region has firmly established itself as the dominant player, propelled by several key factors that have contributed to its strong presence and influence. One of the primary reasons for the Western region's dominance is its industrial strength and the presence of significant pharmaceutical and chemical manufacturing sectors. States like Maharashtra and Gujarat are home to a substantial number of pharmaceutical companies and chemical industries, all of which are major consumers of Acetic Anhydride. The region's robust industrial infrastructure, research and development facilities, and a conducive environment for manufacturing have played a pivotal role in its prominence.

Furthermore, Gujarat, in particular, hosts numerous pharmaceutical manufacturing facilities, ensuring a consistent supply of high-quality Acetic Anhydride. The state's well-developed port infrastructure and logistical advantages make it an ideal location for the import and distribution of this essential chemical, meeting the demands of industries across the country.

The Western region's proactive approach to environmental regulations and its commitment to sustainability have also driven the demand for Acetic Anhydride, especially in the pharmaceutical and chemical industries, which prioritize eco-friendly and high-quality production processes. In conclusion, the Western region's industrial diversity, well-established infrastructure, and strategic advantages have collectively established it as the dominant player in the Indian Acetic Anhydride market. This dominance is expected to persist as the region continues to thrive in various manufacturing sectors, especially in pharmaceuticals and chemicals, and as the demand for high-quality chemicals remains on the rise.

Major companies operating in India Acetic Anhydride Market are:

- Ralingtonpharma LLP

- Jubilant Ingrevia Limited

- Kakdiya Chemicals

- Shree Maruti IMPEX India

- Laxmi Organic Industries Limited

- Balaji Amines

Download Free Sample Report - https://www.techsciresearch.com/sample-report.aspx?cid=20573

Customers can also request for 10% free customization on this report

“India's acetic anhydride industry plays a crucial role in the country's chemical manufacturing sector. Acetic anhydride, a key chemical intermediate, is primarily used in the production of various pharmaceuticals, dyes, and agrochemicals. In recent years, India has witnessed a growing demand for acetic anhydride due to its widespread applications in these sectors. The country's indigenous production of acetic anhydride has steadily increased, reducing the need for imports and contributing to self-sufficiency in the chemical industry. The Indian acetic anhydride market is characterized by the presence of several key players, including manufacturing giants and smaller, specialized companies. This diverse landscape fosters healthy competition and drives innovation within the sector. Furthermore, the Indian government's focus on promoting domestic manufacturing through initiatives like "Make in India" has boosted the growth of the acetic anhydride industry.

However, the sector faces its share of challenges, including environmental concerns and regulatory compliance. The production of acetic anhydride requires a responsible approach to handling hazardous materials, ensuring the safety of both workers and the environment. Stringent regulations are in place to monitor and control the production processes, which companies must adhere to. In conclusion, India's acetic anhydride industry is on an upward trajectory, driven by increased demand in pharmaceuticals, dyes, and agrochemicals. The sector's growing self-sufficiency, diverse competitive landscape, and government initiatives are contributing to its overall expansion. To sustain this growth, industry players must continue to meet regulatory standards and prioritize environmental responsibility,” said Mr. Karan Chechi, Research Director with TechSci Research, a research-based management consulting firm.

“India Acetic Anhydride Market By Application (Coating Material, Explosive, Plasticizer, Synthesizer, and Other) , By End-user (Tobacco, Pharmaceutical, Laundry Cleaning, Agrochemical, Textile, and Other End-user Industries), By Region, Competition, Forecast and Opportunities, 2019-2029”, has evaluated the future growth potential of India Acetic Anhydride Market and provides statistics information on market size, structure and future market growth. The report intends to provide cutting-edge market intelligence and help decision makers take sound investment decisions. Besides, the report also identifies and analyzes the emerging trends along with essential drivers, challenges, and opportunities in India Acetic Anhydride Market.

Contact

Techsci Research LLC

420 Lexington Avenue, Suite 300,

New York, United States- 10170

Tel: +13322586602

Email: sales@techsciresearch.com

Website: www.techsciresearch.com