The Advantages of No-Visit Loans

One of the primary benefits of no-visit loans is the **time-saving aspect**.

The Advantages of No-Visit Loans

One of the primary benefits of no-visit loans is the **time-saving aspect**. In at present's fast-paced world, people frequently discover it difficult to carve out time for in-person appointments. No-visit loans eliminate this want, offering borrowers with entry to funds once they want them most. This speediness could make a significant difference in emergencies or sudden monetary conditi

The web site features an in depth library of articles and guides that cover the varied aspects of business loans, from the types of loans out there to ideas for successful functions. Users can profit from user-generated reviews, which provide real-world perspectives on lenders, serving to companies make well-informed decisi

Additionally, debtors can profit from creating an emergency fund. Having financial savings set aside can provide a buffer in case of surprising bills or job loss, making certain that

Student Loan payments could be met even throughout tough occasi

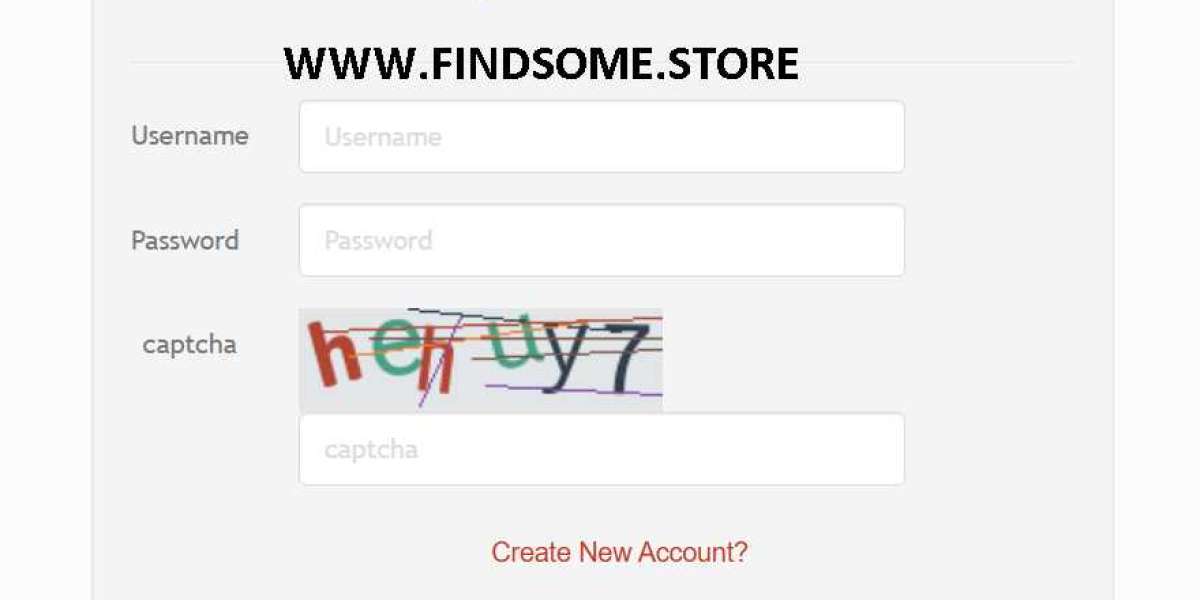

A No-Visit

Same Day Loan is a kind of private mortgage that can be processed entirely on-line without requiring borrowers to fulfill lenders in individual. This process is designed for effectivity, allowing customers to apply, submit paperwork, and obtain funds shortly and conveniently from ho

The flexibility of no-visit loans extends beyond simply the appliance course of. Borrowers can usually select mortgage amounts, compensation phrases, and even have the choice to get pre-approved without impacting their credit scores. This empowers consumers to make informed selections about their monetary needs with out dashing into commitments. Clients appreciate the flexibility to manage their loans entirely from the consolation of their own properties, making it an attractive different to traditional lo

Furthermore, the velocity at which funds are disbursed could be essential in urgent conditions, corresponding to avoiding foreclosure or capitalizing on investment alternatives. In a market the place timing is crucial, the no-document mortgage can provide an important lifeline for fast financial choi

The Benefits of No-document Loans

The enchantment of no-document loans encompasses a number of key benefits. First and foremost, they supply an expedited software process. Unlike conventional loans, the place extensive documentation is required, no-document loans emphasize efficiency, permitting debtors to bypass tedious paperwork and prolonged ready durati

Common Misconceptions About No-Visit Loans

Despite the growing recognition of no-visit loans, misconceptions still exist, leading to hesitation among potential debtors. One widespread myth is that these loans are **associated with predatory lending practices**. While the lending panorama has its bad actors, legitimate on-line lenders are regulated and transparent about their terms. Consumers ought to always research and browse critiques before selecting a lender to mitigate the risks related to unsolicited off

It is also crucial to handle repayments successfully. Failure to take action may lead to extra substantial money owed as a outcome of accruing curiosity and potential penalties. Prospective borrowers ought to rigorously think about their monetary scenario and solely borrow what they can afford to repay comforta

To qualify for a no-document mortgage, debtors usually need an affordable credit score and to offer fundamental information concerning their monetary scenario. Most importantly, they need to be prepared to specify their stated income, as lenders will rely closely on this information when evaluating the mortgage softw

However, whereas no-document loans offer many advantages, they might also carry larger risks for each lenders and borrowers. Because lenders rely closely on the borrower's stated revenue, there is a danger of default if the borrower's monetary situation isn't as stable as they claim. As such, understanding the nuances of those loans is vital for both events concer

Small loans provide a valuable financial solution for individuals and companies in search of fast access to money. With the evolving landscape of financial companies, small loans stand out for his or her flexibility and accessibility. They are designed to meet pressing needs, such as sudden bills or short-term projects, without overwhelming borrowers with hefty quantities. In this article, we are going to discover small loans intimately, including their advantages, sorts, software processes, and associated concerns to help you make informed decisions. Additionally, we will introduce BePick, a comprehensive useful resource for those interested by small loans and their opti

Additionally, no-visit loans usually include **competitive curiosity rates** compared to traditional loans. By reducing overhead costs related to maintaining bodily workplaces, on-line lenders can move savings onto consumers. This means debtors can doubtlessly safe better phrases and conditions on their loans. With the advent of varied online platforms dedicated to personal financing, shoppers can easily examine completely different lenders and select the one which most accurately fits

my homepage their ne

The Benefits of White Sun-Blocking Sheers with UV Protection in the Fashion Industry

The Benefits of White Sun-Blocking Sheers with UV Protection in the Fashion Industry

Купить диплом учителя.

Купить диплом учителя.

Unlock Exclusive Rewards with the Top 1Win Bonus Code for 2025

By Aubree Swift

Unlock Exclusive Rewards with the Top 1Win Bonus Code for 2025

By Aubree Swift 1Win Canada Betting Site Review: A Comprehensive Look

By Aubree Swift

1Win Canada Betting Site Review: A Comprehensive Look

By Aubree Swift BetWinner Promo Code 2025: Unlock VIP Tier Access with LUCKY2WIN

By Aubree Swift

BetWinner Promo Code 2025: Unlock VIP Tier Access with LUCKY2WIN

By Aubree Swift