n Eligibility for a small loan varies by lender however typically includes components similar to minimal age, employment status, and creditworthiness.

n Eligibility for a small loan varies by lender however typically includes components similar to minimal age, employment status, and creditworthiness. Most lenders require debtors to be at least 18 years old, demonstrate a secure supply of revenue, and should perform a credit score check to gauge threat. Some lenders might contemplate various elements for these with poor cre

Once your application is submitted, the lender will assess your data and determine your eligibility. Many lenders can present a choice within hours and even minutes, enabling fast entry to funds. However, be prepared for potentially greater rates of interest and fees, especially if your credit score just isn't in prime sh

The Role of 베픽 in Your Search

베픽 is an excellent resource for freelancers seeking data on loans tailor-made to their unique circumstances. This platform supplies comprehensive evaluations of various lenders, providing insights into the terms, advantages, and drawbacks of various mortgage produ

Another benefit is the accessibility of these loans. With numerous lending choices obtainable today—ranging from conventional banks to on-line lenders—borrowers have the opportunity to check rates and terms, empowering them to decide on the most effective financial solutions for their ne

However, borrowing should solely be considered after an assessment of 1's monetary state of affairs. For long-term monetary goals or larger purchases, alternative financing options could additionally be more beneficial. It stays essential to gauge if the month-to-month repayments fit inside your finances, guaranteeing that compensation does not result in further financial hards

Why You Might Need an Emergency Fund Loan

Financial emergencies can occur to anyone, and having a plan in place for such situations can prevent from vital stress. Whether it's a sudden medical invoice or surprising residence repairs, an Emergency Fund Loan can provide the mandatory funds rapidly. It allows you to tackle urgent points without having to drain your savings or resort to high-interest bank ca

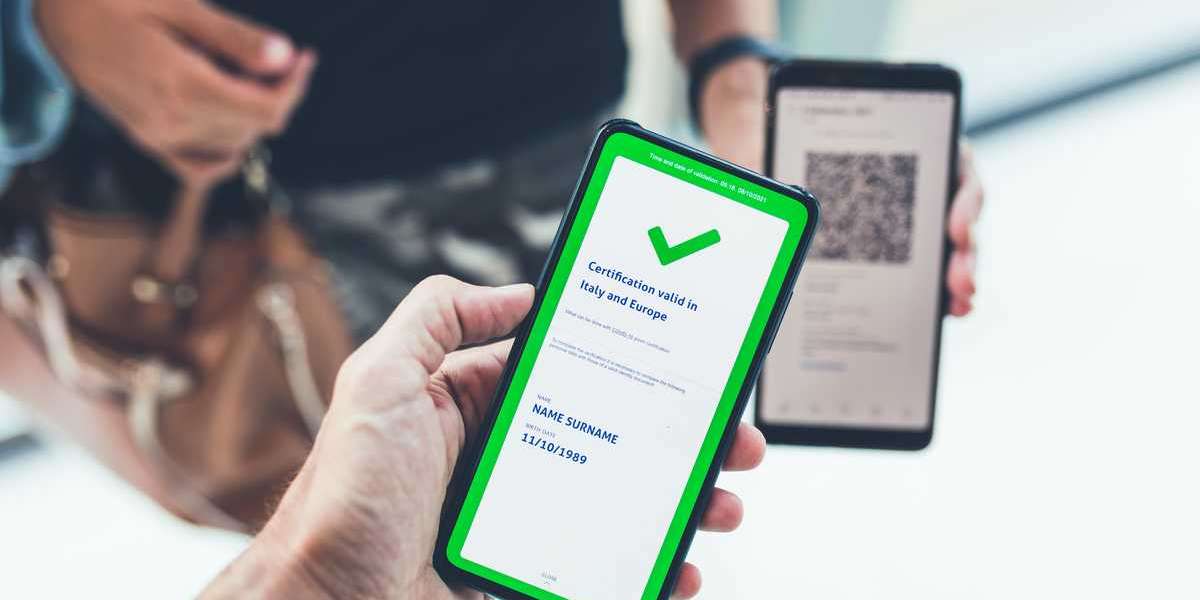

Additionally, lenders will think about the applicant's age, often requiring debtors to be no less than 18 years old, and so they may additionally require a government-issued ID. Some lenders could conduct a background examine, although this varies extensively among lending instituti

In conclusion, monthly loans can function valuable financial instruments when used responsibly. By understanding their features, benefits, and potential risks, debtors could make informed selections that align with their monetary goals. Resources like 베픽 can improve this understanding, offering important data and steering to navigate the complexities of month-to-month loans successfu

When to Consider a Small Loan

Small loans are ideal in conditions the place instant funds are required, however the quantities needed are relatively modest. Typical situations embody pressing house repairs, surprising medical expenses, or even seasonal expenses similar to holiday purchasing. They can also assist individuals aiming to consolidate minor money owed right into a single payment, probably simplifying management and minimizing interest co

How to Apply for an Emergency Fund Loan

The application process for Emergency Fund Loans is generally straightforward. Most lenders supply online functions, allowing you to fill out essential info from the comfort of your house. You'll usually need to offer personal and monetary details, together with your income, bills, and current de

Managing Repayment of Your Emergency Fund Loan

Once you have obtained an Emergency Fund

Loan for Day Laborers, managing its repayment becomes critical. Failure to repay on time can harm your credit rating and lead to additional charges. Establish a finances that includes your loan repayment quantity, making certain you'll have the ability to meet your obligations whereas still covering needed dwelling expen

Through an easy-to-navigate interface, BePick supplies important knowledge that highlights key options of different loan varieties particularly tailored for day laborers. This info can embrace interest rates, reimbursement terms, and eligibility standards, permitting customers to weigh their options effectiv

Day Laborer Loans are particularly designed for individuals who work on a day-to-day or temporary basis. This kind of mortgage recognizes the unique financial challenges confronted by people whose incomes can fluctuate significantly from week to week and even day to day. The major benefit of such loans is that they offer quick access to money with out the stringent credit score

Debt Consolidation Loan requirements usually associated with traditional lo

Reading customer evaluations and consulting with fellow freelancers can even supply perception into which lenders are trustworthy and provide glorious customer service. Taking the time to research can save you cash and headaches in the lengthy t

Along With Waxes

Along With Waxes

The Benefits of White Sun-Blocking Sheers with UV Protection in the Fashion Industry

The Benefits of White Sun-Blocking Sheers with UV Protection in the Fashion Industry

Less = Extra With Lash Cosmetics Vibely Mascaras

Less = Extra With Lash Cosmetics Vibely Mascaras

Unlock Exclusive Rewards with the Top 1Win Bonus Code for 2025

By Aubree Swift

Unlock Exclusive Rewards with the Top 1Win Bonus Code for 2025

By Aubree Swift Three Reasons Why You're Private Psychiatrists Is Broken (And How To Fix It)

Three Reasons Why You're Private Psychiatrists Is Broken (And How To Fix It)